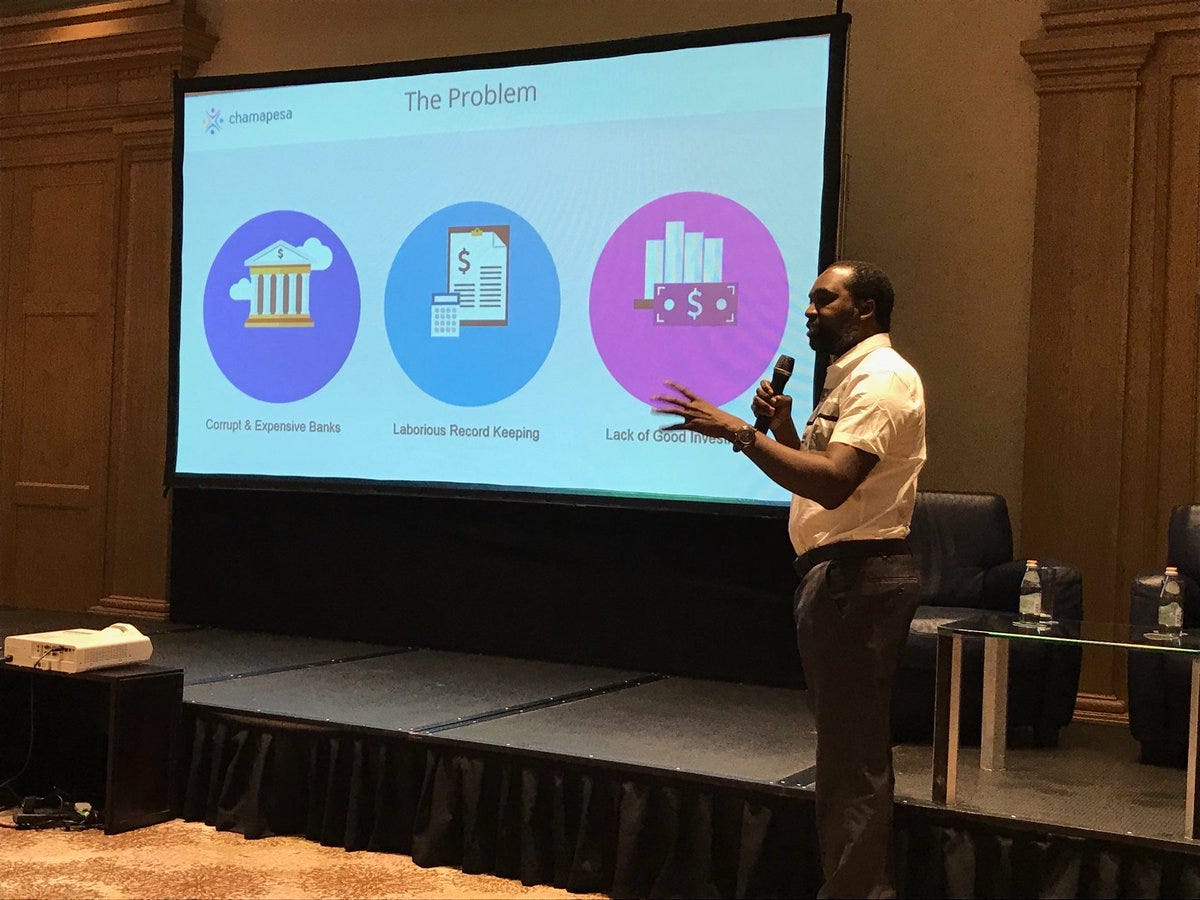

Back in 2018, i had a deep dive into crypto, as head of product for chamapesa, a blockchain platform for rotating credit-saving groups which are popular in Africa. There were not yet serious real-world applications aside from speculation. Today, thousands of projects in DeFi (decentralised finance) and NFT (non fungible token) are live on the Ethereum platform, Bitcoin is becoming a legal currency in Salvador and new blockchains (Cardano, Solana, Flow, Dfinity) are popping up everyday. The technology is maturing and the usage has scaled to reach unexpected regions.

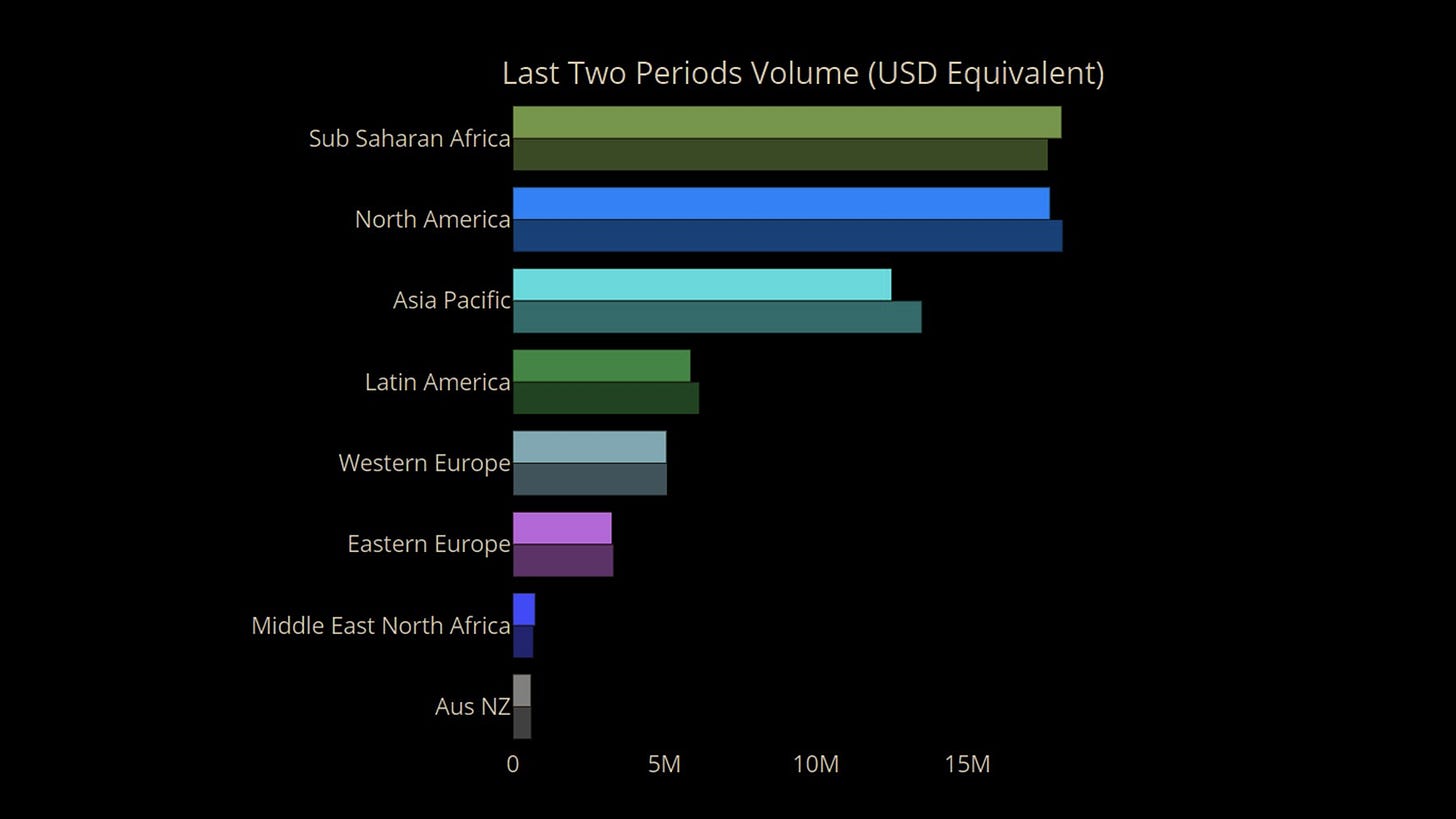

“Africa now has the largest amount of #Bitcoin peer-to-peer trading volume in the world—even more than North America. 🌍”.

It is not common to see Sub-Sharan Africa leading the rest of the world, in tech. This happened with Mobile Money and it is always a sign of a major tectonic shift, which this time has started from the ground up. It is not coming from institutions, corporations or governments but from private circles online, despite regulations.

For local regulators (and fintech execs), crypto is all about currency replacement, loss of capital control or token speculation competing with their regional stock markets. For the layman, especially here in francophone Africa, crypto means "get rich quick scams”, "shit-coin based Ponzi schemes" or hackers. Sadly, these are the only crypto news in the press.

Yet, the technology breakthrough underneath, is far more profound.

When i first got a Mac, what was fascinating for me was not the performances, but the ART embedded everywhere from the software to the hardware. I later discovered that Steve Jobs, after dropping out of college, decided to take typography courses and that has modelled all of Apple’s products still today. From the Mac to the iPhone, this unusual combination between tech and art has changed dozen of industries, making Apple one of the greatest companies of all times.

When Steve Jobs passed away, I wondered about the next domain which, added to computing, could create a similar impact. In 2018, i was attending the CoinAgenda crypto event in Malta and started paying attention to the terminology: smart CONTRACTS, token GOVERNANCE, transaction CONSENSUS, PROOF of work. It suddenly clicked. It was about LAW. Crypto is actually bringing law into computing.

Chris Dixon refers to blockchain as Trust guaranteed by Code (software), enforced by Cryptography (Math), instead of lawyers and judges.

Bitcoin came as a crypto-currency but Trust is the key to its success (where previous experiments failed): no single individual or corporate or government controls it; the maximum number of bitcoins is set to 21 millions and will not change, transactions are validated by myriads of nodes distributed around the world and coordinated in such a way none can block or tamper with overall platform and you don't need permission to send or receive bitcoins, from or in your own wallet. These properties may not be flawless, but their combination creates a unique System of Trust that was simply impossible before.

In the African context, here are few concrete cases why such properties are even more relevant:

Governance. Once every few years, people in our countries trust and elect a leader, who after a couple of terms may decide to change the constitution to run for a 3rd , 4th , Nth terms. Then the country struggles to attract investors or to levy taxes as everyone tries to evades them, opponents start cooking a coup or a rebellion until when they get to power, only to fall for the same temptation. This is is Africa, say the cynics. Once trust is corrupted from the top, the “infection” spreads across the entire nation. This is why crypto “Trust by code, enforced by math” is a major revolution in governance. Imagine being able to set a max number of terms (say 1 term per leader) in such a way that even elected leaders can’t change. This a strong commitment crypto enables.

Documents fraud. Say you are an African migrant living overseas. After decades of hard work, you decide to invest in a piece of land to build a house for your old days in your home country. After hundreds of thousands dollars invested, you go back home and realise that the property documents are actually fake and the land was resold to another owner. So many in the diaspora have been hit by such frauds. With crypto technologies, official documents can be locked on a blockchain with some proof of authenticity that cannot be overwritten or double sold. This why the current NFT phenomenon isn’t a fad.

Informal Sector. Say your are a street vendor of retail goods, local fishery boat captain or an informal bus driver. After an exhausting day of hard work, you have to repay the majority of the proceeds to the bus owner, retail dealer, boat owner after many other operational expenses and only bring home the left-overs. Today you may break even, but the next day may come at a loss and the following one, you may be sick. The asset owner won’t offer a regular work contract as he does not trust you; He keeps complaining about his lack of visibility on the overall revenues and tries to hike the daily rent of his assets. As a result, you start under-declaring the cash revenues in your best days. Collaborating in a trust-less environment creates a vicious cycle which makes it impossible to scale. Blockchain could bring the much needed trust and transform our informal economy in retail, mobility, agriculture…

Crypto-currencies aren’t the only applications of blockchain platforms. The possibilities are much broader and will soon spread across the entire economy. Dfinity’s Internet Computer ($ICP), for example, is a blockchain invented to replace the massive cloud hosting industry. Your next startup may not run on Amazon AWS and your next enterprise project may not run on Microsoft Azur. Instead, it may be living on ICP’s blockchain with a decentralised network of independent nodes around the globe. Every fintech, social network or vertical app will soon have a crypto layer.

The crypto phenomenon is even taking on the traditional joint-stock company as we know it today with decentralised autonomous organisations (DAOs). A DAO has no HQ and no central management. The “company is a piece of software code”, not a legal paper in a juridiction. The rules and the decision making process are written in smart contracts, autonomously executed on a blockchain. Bitcoin somehow is a DAO. Most crypto projects are taking this route, at least leaving some decisions to token holders to vote on (governance by staking tokens).

Crypto technologies are creating new ways to organise humans for greater cooperation. Think of what bees and ants achieve with native cooperation.Humans, are social species. We are thriving today not because we are stronger, fiercer or faster but because we can collaborate intelligently and efficiently. Yet, our most powerful organisations (tribes, empires, countries, institutions, companies) quickly collapse as soon as our trust in them starts to decline. Crypto combined with the Internet is the first technology able to remove this major barrier in human history and set ambitious new forms of organisations.

You will soon be able to log to the internet from any country in Africa, start a project with others, wherever they live, build and launch it on a blockchain and let the community of customers-owners govern it, openly. They may never even know who you are. After all, none knows who Satoshi Nakamoto is.

Our governments and regulators may think they need to protect their currencies. Some may want to cosy up to the ex colonial power or spare some powerful local forces. In reality, they may be holding our citizen back from once in a lifetime revolution where our youth should (and hopefully will play) a major role.

If you are a developer, a fintech founder, an informal entrepreneur, an aspiring angel investor or simply a citizen worried about the many unsolved socio-economic issues around you, here is why you should pay attention to the crypto revolution.